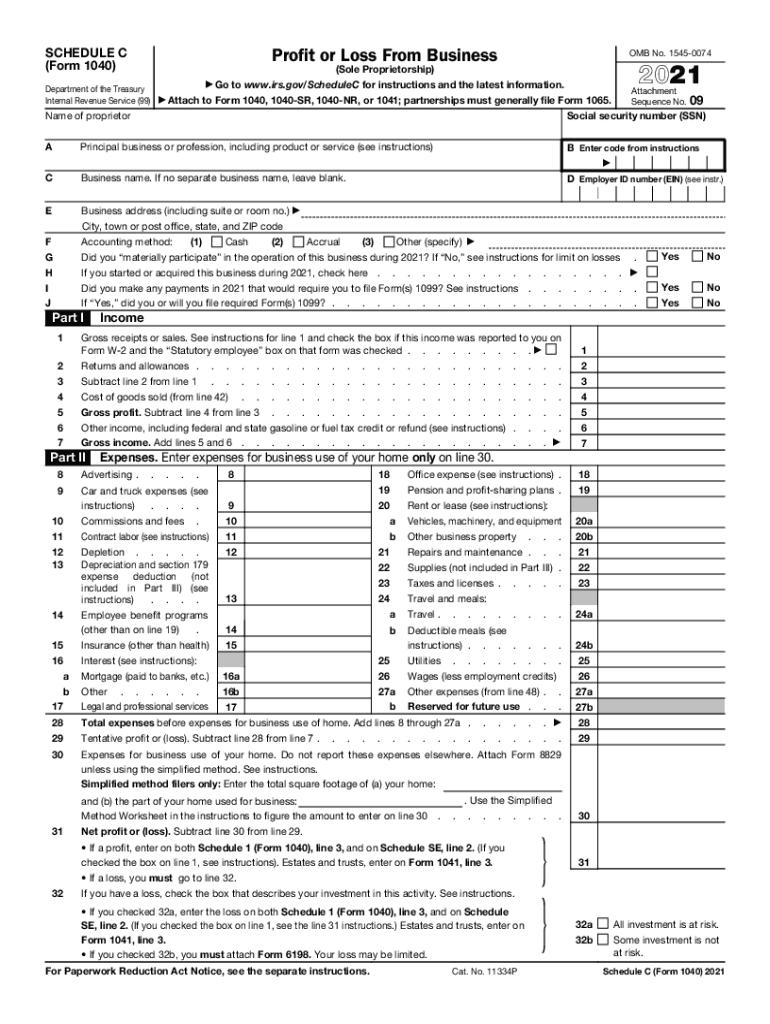

Instructions Schedule C 2024 Tax Form – The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 /EINPresswire.com . These limits are noted in the table below for both the 2023 and 2024 tax years Service. “Schedule C: Profit or Loss from Business,” Page 1. Internal Revenue Service. “2022 Instructions .

Instructions Schedule C 2024 Tax Form

Source : www.nerdwallet.com2023 Instructions for Schedule C

Source : www.irs.govHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Source : instruction-schedule-c.pdffiller.comOn January 11th, JaEcklebarger will be teaching our “Schedule

Source : www.instagram.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comSchedule c form: Fill out & sign online | DocHub

Source : www.dochub.comSchedule C Form 1040 Sole proprietor, independent contractor, LLC

Source : m.youtube.com1040 schedule c: Fill out & sign online | DocHub

Source : www.dochub.comInstructions Schedule C 2024 Tax Form What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet: Here are our top picks for the best tax apps to help you file your tax return in 2024 and forms. Users have access to Schedule SE for self-employment taxes and Schedule C to report business . Kemberley Washington is a tax journalist and provides as wages on line 1 of Form 1040, while self-employed persons typically would report it on Schedule C, “Profit or Loss from Business.” .

]]>